The four key metrics of personal finance

The book Accelerate: The Science of Lean Software and DevOps introduced the concept of the four key metrics for measuring the software delivery performance of technology organizations. Since then, many software development teams have used these metrics as a north star to understand if they are improving their software delivery capability.

As a software engineer I have used these metrics in several projects to analyze potential areas of improvement in our ability to delivery quality software fast. During the last year, I asked myself if I could apply the concept of the 4 key metrics to several areas of my life, including finance. What would be the 4 key metrics for measuring the performance of my personal finances? How could I track them?

In this post I will describe the 4 metrics I choose and the thinking process that let me to pick them.

Motivation

Over the last few years, I became more interested in personal finances and began to educate myself on the topic. I like to apply a lean mindset to managing my finances as I don't enjoy spending too many hours tracking expenses and money in and out of my accounts. Since the beginning, I want to have a system that gives me a high-level view of my financial health and performance.

My long-term goal is to create a system that allows me to achieve financial freedom. This term could have several meanings, freedom means different things to different people. In my case, I understand financial freedom as a state where money doesn't condition my lifestyle decisions.

Achieving financial freedom doesn't necesarialy mean that I would like to stop working and retire to an isolated island. Still I want to have the flexibility and the privilege to not having to worry too much about money and do the things I like, e.g. continue traveling the world.

The selection criteria

I started by reflecting on all the things I learned about personal finances over the years. Mostly focusing on things people always give importance to, like paying off your debt, trying to save every month, having an emergency fund, etc.

I already had a tracking system in place based on a spreadsheet so I went through the metrics I was tracking and I started prioritizing them based on their impact on my long-term financial goals. I also differentiated the ones that are within my control, e.g. spending, from the ones that are not, for example, investment returns as I don't find very useful to track things that are not partially under my control.

The metrics

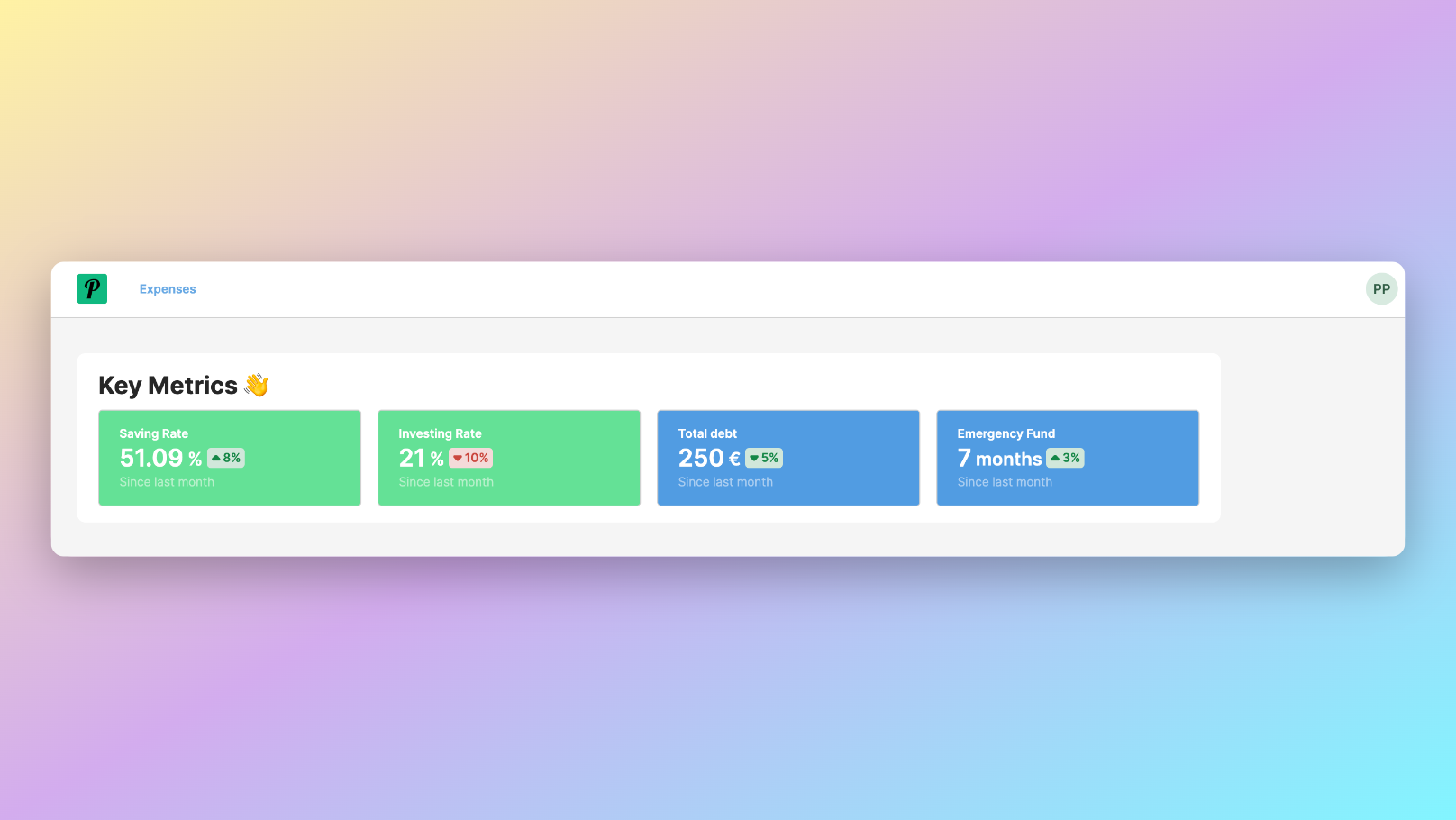

After completing this process, I arrived at the following 4 metrics that I consider key to understanding my financial health:

- Average Monthly Saving Rate: Percentage of my total monthly income that I am able to save measured as an average over the last 12 months.

- Average Monthly Investment Rate: Percentage of the total monthly income that I invest measured as an average over the last 12 months. This metrics cover the money that I invest in index funds and other assets.

- Total Debt: Amount of money I owned. In general, prioritizing paying off debts above investing is a good idea. Although there are cases where the opposite is also true.

- Emergency Fund Runway: Number of months with covered basic lifestyle expenses. In other words, how many months I could live out of my saved and easily accessible money? My goal is to have a runaway of 6 months or more based on my average spending per month.

I believe all of these metrics are great leading indicators of how I am doing financially. If we take the categorization from the original 4 key metrics by DORA as a reference, we could also split the metrics into two main categories:

- Financial performance: They help you to understand if you are improving the chances to increase your total wealth over time. By increasing your saving and investment rates you increase the likelihood of becoming wealthier over time.

- Financial stability: They help you to understand how financially resilient you are if something unexpected happens, e.g. if you lose your job. Having several months of runway in your emergency fund and no debt to repay will allow you to overcome financial challenges more easily.

Disclaimer: I am not a financial advisor. This post is not meant to be used as financial advice. The metrics that work for me and my current situation may not work for everybody. I encourage you to take them only as a reference and come up with your own.

Next steps

Tracking these metrics already triggered possitive results. They help me reflect on my finances and make adjustments if needed. They give me a lean and practical way to manage my wealth creation process.

I review my finances and manually update the data required to calculate these metrics monthly. Similar to what we do in software delivery teams, I would like to start automating the process of gathering the data to calculate them automatically. I have a few ideas on how to do it. I may try to cover some of them in a future post.

I want to show you a sneak peak of what I am building. The data displayed is not real.

And you, do you agree with these metrics? What are the financial metrics you track? Feel free to reach out by email or on Twitter. I am always willing to learn more about this topic and improve my current system.